CARES Act Paycheck Protection Program Loan Breakdown

Loan Amount

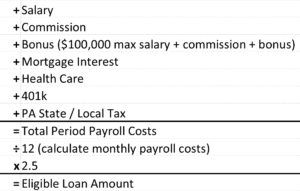

The loan amount is based on the following over the time period 4/1/2019 to 3/31/2020:

Allowed Uses

Payroll Costs (Salary, Commissions, Paid Sick or Medical Leave)

- Health Care Benefits

- Mortgage Interest

- Rent

- Utilities

- Interest on Other Debt Obligations

Loan Forgiveness

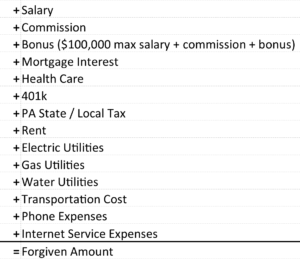

Loan is initially deferred for 6 months. The amount that can be forgiven is calculated based on the following costs that are incurred in the 8-week period following the origination date of the loan:

For 100% forgiveness, costs other than payroll need to total 25% of one month of payroll.

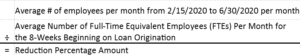

The forgiven amount will be further reduced based on the following percentage (average number of employees calculated as the average number of employees for each pay period within a month):

The forgiven amount will be further reduced if the salary or wages of an employee making less than $100,000 is reduced by more than 25% from Q4 2019. If employee headcount is reduced during this period, ensure that page 48 of the bill is carefully reviewed.

Canceled indebtedness resulting from the loan forgiveness will not be included in the borrower’s taxable income.

Forgiveness Documentation Required

- Payroll tax filings

- State income, payroll and unemployment filings

- Cancelled checks for rent and utility payments

Loan Rates

For any amount not deferred:

- Maximum 10-year period

- Maximum rate of 4%

What the Banks Get

- Initial fees of paid by the government:

- < $350,000: 5%

- $350,000 – $2,000,000: 3%

- $2,000,000: 1%

- Reduced capital requirements

- Loan risk weight of 0%

- Government payment on interest accrued at the time the loan is forgiven